Following the change of administration, Malaysia is reviewing the current 5G deployment plans and it aims to expedite the 5G rollout to hit 80% 5G population coverage by the end of this year. Ahead of the government’s decision on the current single wholesale network (SWN) model with Digital Nasional Berhad (DNB), GSMA has released a report outlining implications if Malaysia still continues with the existing 5G model.

During our interview with GSMA’s Head of Asia Pacific, Julian Gorman, he has put a lot of emphasis on infrastructure competition to drive innovation for Malaysia. As highlighted in the report, the propensity to innovate is reduced in an SWN environment where no infrastructure competition exists.

GSMA believes infrastructure competition is a key underpinning for innovation, whether in private networks, edge compute or Open RAN and has gained momentum in many countries as a means to reduce cost, increase agility and drive vendor competition. Without a change in direction, Malaysia faces a competitive disadvantage on a number of network fronts including Open RAN, 5G Advanced and Satellite.

The true success of 5G isn’t population coverage

When we asked if there’s a need to speed up 5G deployment given that the current 5G adoption is low, Gorman said population coverage is a KPI of the past when mobile generations were very consumer-driven. He said it’s not to say that Malaysia doesn’t have a lot of consumer needs or opportunities for 5G but the focus should be on innovation and take-up rate, as the true success of 5G isn’t population coverage. He shared that Rwanda has a very good 4G coverage from its SWN but then later decided that it wasn’t getting the innovation and take up that it was set up to do.

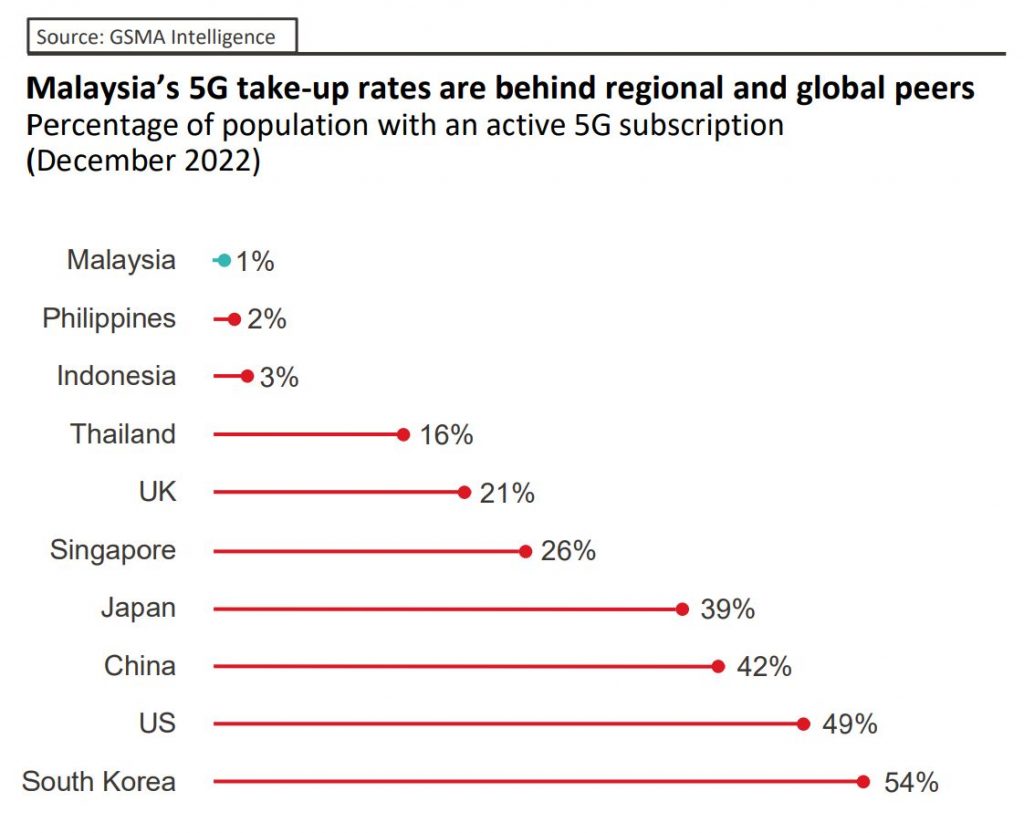

While it’s admirable to aim to roll out 5G to reach 80% population coverage in a very short time, the priority should be looking at adoption, innovation and use cases that can transform the industry. As shared by GSMA Intelligence, Malaysia currently has a 1% adoption rate of 5G as of December 2022 despite achieving close to 50% 5G population coverage.

Malaysia’s ambition is to be a regional leader but its neighbours have been developing new innovations with 5G. Thailand has 5G ports and 5G smart hospitals, while Singapore has a 5G-enabled highly automated car manufacturing facility with Hyundai locally-assembling Ioniq 5 EVs on the island republic.

Why is 5G adoption in Malaysia still low?

With over a year of 5G rollout with sizeable 5G population coverage in Klang Valley, 5G adoption remains low among enterprises in Malaysia. When we asked Gordan for his take, he said there has been a period of uncertainty in Malaysia’s political and 5G landscape. While large enterprises have more capabilities to deal with uncertainties, small and medium enterprises can’t afford to fail and they want to have certainty about the technology available, so there’s a bit of a standoff.

Without competition, innovation and investment, there won’t be as many people pushing the boundaries as hard. He shared Thailand has numerous use cases and innovations across the operators and historically, markets with competitive networks drive innovation. With Malaysia’s ambition to transform its economy to be a regional leader in digital, it has to compete on a global scale for innovation and investment. He shared Singapore launched its third 5G licence to stimulate more innovation because it knows that it is competing for innovation. India launch 5G last year with ambitious plans and it wants to be a 6G leader by 2030.

Gordan said Malaysia should play to its strengths as it has a unique position as it is geographically located between China, India and Indonesia which are set to be 3 out of 5 of the biggest economies in the world. With cultural, language and ethnic ties, Malaysia is setting itself up to be that intersection between these three countries and it has to compete for them. He added, 5G population targets are nice ambitious targets and can provide confidence, but is it enough to set Malaysia up for the next 10-15 years?

Will 5G costs more with multiple competing networks?

DNB warned that building a second 5G network is not in the national interest and it would delay and increase the cost of 5G deployment in the country. When we asked Gordan about potential cost concerns if there are two 5G networks, he said several studies show that a good network infrastructure sharing framework will enable operators to share infrastructure which will result in similar cost efficiencies as SWN.

On the concerns of quality when the spectrum is shared across network providers, he said there are neighbouring countries that have competing networks and yet have enough spectrum to support them. He believes Malaysia does have enough spectrum to support more than one 5G provider.

While there’s also the possibility of giving spectrum directly to all 4G telcos, he shared it is unlikely that a country will have five or six 5G networks. Realistically, there’s likely to be consolidation and collaboration for 5G deployment with two or three main players.

At the moment, local telcos are not allowed to use their existing spectrum for 5G and there have been calls for the government to reinstate technology neutrality. GSMA strongly believes in technology neutrality for spectrums to allow telcos to maximise efficiency which will enable higher data speeds and lower prices for consumers.

SWN is viable to boost rural connectivity

Although SWN has yet to prove to be effective on a national level, GSMA does support the use of a single network where infrastructure competition is not viable. Gordan gave an example in the United Kingdom, where there’s a collaborative joint venture between telcos to build a single rural network. However, in central London, you’ll find network competition because that’s what drive innovation, adoption and coverage.

He said, a country could roll out a single 5G network but is it going to achieve the long-term goals? Will a SWN support a landscape that’s going to create innovation to transform the industry considering 5G is an enterprise generation? 5G isn’t just about mobilising things, but also about transforming the way manufacturing works, hospitals delivering their services and a complete transformation that a country is looking to achieve. It is about making sure that we build a landscape that sets up for a long term vision, not a 12-month coverage target.

What if DNB becomes a private-led SWN?

When asked about the potential of DNB becoming a private-led consortium, Gordan said telcos were trying to work towards a consortium model back in 2020. At the time, he said GSMA has shared their reservations about a having single network. But in the hands of the industry, he said there’s at least a competitive drive to make things happen.

He repeated that history and the economy show competition drives innovation. This is especially for an innovation generation which relies on the network. There are various use cases where a vertically integrated collaboration comes together and mobile operators play an important function. That’s why we see private networks as incredibly important in driving innovation, another area that Malaysia is currently constrained.

You can read the full GSMA Intelligence report here.

0 comments :

Post a Comment