Maybank celebrates MAE‘s 5th anniversary and they are rewarding customers with returns of 5% p.a. They are also offering rewards and cashback promos for digital payments to celebrate the milestone.

Since its inception in 2020 as a digital banking app, MAE has facilitated over RM4 trillion in digital transactions. According to Maybank, the transaction volume is equivalent to twice of Malaysia’s GDP and they are accelerating the pace of financial inclusion and digital connectivity in the country and across ASEAN.

During the launch, Maybank Group CEO for Community Financial Services Taufik Albar said, “Over the years, we have continued to transform the MAE App into an integrated financial lifestyle app that addresses our customers evolving needs, and helps them perform everyday transactions in a more seamless, secure and personalised way.”

MAE now has 10.7 million users

Today, MAE has 10.7 million users and commands 48% market share of mobile banking transaction volume in Malaysia. As the first bank in Malaysia to introduce QR payments in 2017, Maybank says it continues to lead in cashless transactions, empowering individuals and businesses to send and receive payments instantly via Maybank Scan & Pay at zero transaction fee.

Maybank shared that the total number of Scan & Pay transactions performed via the MAE app grew 51 times as of August 2025, compared with 2020. In 2024 alone, Maybank recorded a 26% increase in new merchant sign ups, broadening acceptance to more eateries and retail outlets nationwide.

Maybank Group Chief Technology and Digital Officer Giorgio Migliarina said, “The MAE App has redefined everyday banking, blending lifestyle and financial features in one app. Empowering Malaysians to take charge of their financial goals, the MAE App has enabled customers to create close to eight million Tabung, strengthening their savings habits and long-term financial planning.”

He added, “With its ease of use, nine out of 10 MAE Wallet customers actively use it for their day-to-day transactions, with many highlighting its safety and robust security as the reason. This trust motivates us to continuously enhance the MAE App to deliver even more value and protection for our customers.”

New and upcoming features on MAE

During the media event, Maybank highlighted its recently added features for MAE and they have provided a glimpse of what’s to come.

For international travellers, there’s the Maybank Global Access Account-i which boasts having one of the best rates for foreign currency exchange. It offers zero conversion fee and users can earn monthly bonus profit rates from your balance. The MAE app will soon introduce a Future order feature where users can set the account to buy or sell currencies at your preferred rate.

The multi-currency account lets you store 18 currencies and you can buy and sell at anytime. It also comes with its own debit card which can be added to Apple Pay and Samsung Pay.

The MAE app also has a Zakat Calculator and Dashboard feature which aims to help users to fulfill their religious obligations with ease. The banking app currently also features Insurance and Takaful products which covers medical, car, motorcycle, travel, personal accident and home. MAE has teased that it will soon introduce Micro Insurance products on its platform.

To provide greater peace of mind, MAE has been adding new security features including Kill Switch and most recently Money Lock. Launched early this year, Money Lock allows users to lockout a portion of their funds, making it totally inaccessible for online transactions and potential scammers. To unlock or decrease the locked funds, users are required to visit a Maybank branch or ATM to do so.

Maybank is also increasing its safely measures with Malware Shielding. According to the bank, the app’s built-in preventive security feature is able to scan your device for any potential malware or security risk, protecting you from potential security threats.

Maybank has also said that it will double MAE’s wallet size to RM20,000 next year and they are also allowing users to open a new Amanah Saham Nasional Berhad (ASNB) account directly from the app itself. In addition, MAE users will soon be able to view and redeem their TreatPoints natively on MAE, without accessing an external web portal.

MAE Turns 5 promotions

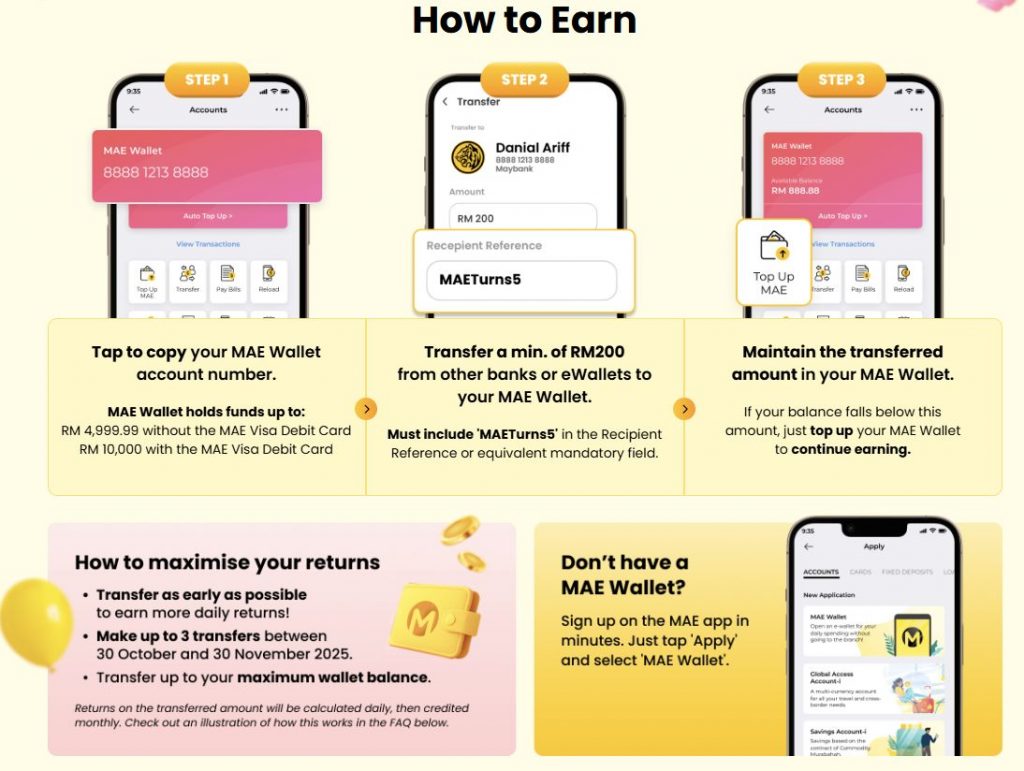

To celebrate MAE’s 5th year milestone, Maybank is running several promotions including 5% p.a. returns for a limited time. To enjoy this perk, just transfer a minimum of RM200 into your MAE wallet from 30th October to 30th November 2025 from other banks or eWallet to your MAE Wallet with ‘MAETurns5‘ as the recipient reference.

To maximise the returns, MAE recommends users to transfer funds as early as possible and the high returns are applicable throughout the campaign period from 30th October 2025 to 31st January 2026.

Users can make up to eligible 3 transfers between 30th October to 30th November 2025. Here’s Maybank’s illustration of how you can earn 5% p.a. returns based on the three batch of transfers along with spending in between:

MAE users are allowed to transfer up to their maximum wallet balance. If you have a MAE Visa Debit Card, the maximum wallet size is RM10,000, while for non-MAE Visa Debit Card holders, the wallet size is RM4,999.

The returns are calculated daily from 30th October 2025 to 31st January 2026, and credited monthly into the MAE Wallet. Returns are awarded on a first-come, first-served basis and the promotion will end once the Eligible Transfer Period ends or when the RM283 million total deposits is reached, whichever comes first.

You can learn more in the official FAQ and T&C.

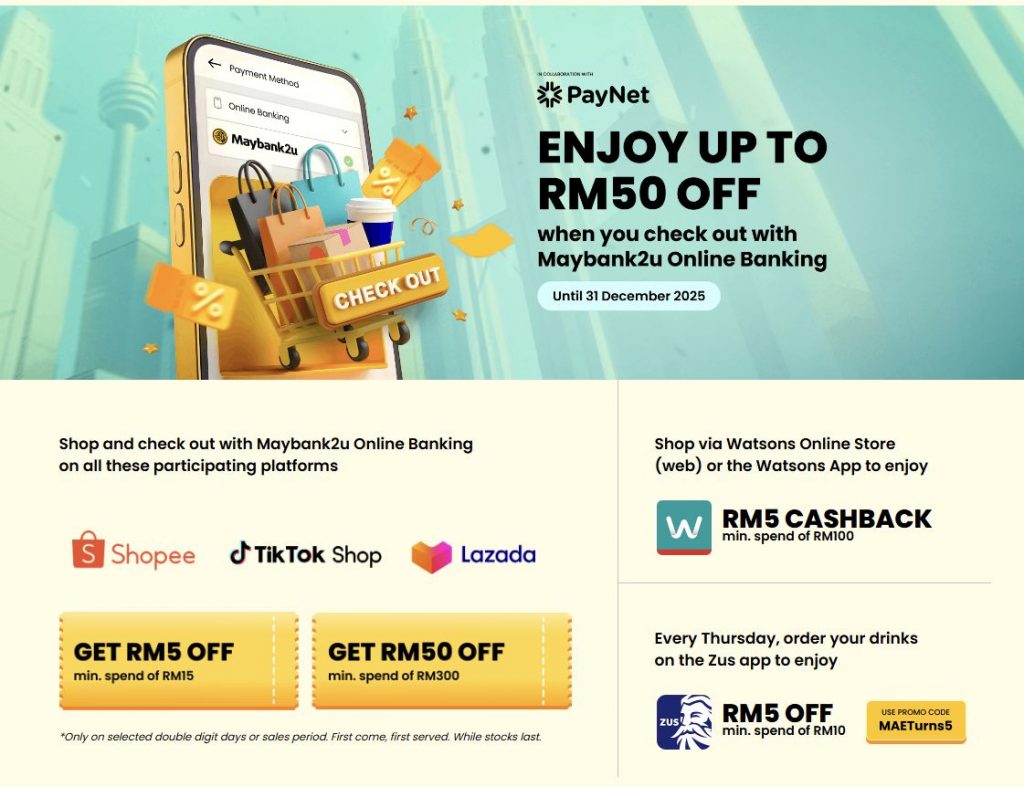

Maybank MAE is also offering rewards up to RM50 off when you check out via Maybank2u online banking. This Maybank2u Check Out campaign runs from 1st October to 31st December 2025 and it is applicable on Shopee, TikTok Shop, Lazada, Taobao, Watsons and Zus Coffee.

On the eCommerce platforms, you can get RM5 off with a minimum spend of RM15 and RM50 off with a minimum spend of RM300 during selected double digit days or sales period.

For Watsons, you can get RM5 cashback with a minimum spend of RM100 during their selected sales period.

Meanwhile, the Zus Coffee App lets you enjoy RM5 off with a minimum spend of RM10 on Thursday (between 30 October to 31 December 2025) when you check out using Maybank2u using the promo code MAETURNS5. The Zus promo is limited to the first 5,000 redemptions per week on a first come, first served basis.

You can learn more about the Maybank2u Check Out promo here.

Last but not least, there’s a Scan & Pay campaign on MAE where you can get up to RM15 Cashback. To enjoy this perk, you’ll need to complete 5 QR payments with a minimum spend of RM15 each via the Scan & Pay feature on MAE.

This campaign runs from 1st November to 31st December 2025, and it is applicable at over 1 million Maybank merchants as well as other merchants with the pink DuitNow QR code. Make sure you opt-in for the Tap Track Win to participate in the campaign.

0 comments :

Post a Comment