Travelling overseas soon? Instead of queuing up to buy currency at the money exchange or using credit or debit cards, why not get a prepaid card instead? Here’s the list of the best visa prepaid cards that you can use for your next overseas trip.

Why use a Prepaid Card for travel?

Some of you might ask, why a prepaid card? Why not just use your existing debit or credit card from your bank?

Well, the first advantage is better control and security. With a prepaid card, you can reload precisely what you need for your overseas spending. Also if you lose your card, you can minimise the risk of exposing details of your debit card that’s linked to your savings account. As you know, filing a dispute for debit card transactions can take a while, so why not save the hassle by using a separate prepaid card for your travel?

Another advantage is lower fees. In most cases, travel-focused prepaid cards offer lower rates for foreign transactions and even cash withdrawals from ATMs overseas. In some apps, it will even show the real-time exchange rates of the country you’re in, which is extra convenient.

The third advantage is a multi-currency wallet. Some prepaid cards let you hold different currencies and this means you can buy and keep foreign currencies like Euro, US Dollars or British Pounds when the rates are low. This helps you save when the exchange rates are high and you don’t have to worry much about the fluctuating currency exchange rates.

BigPay Visa Prepaid

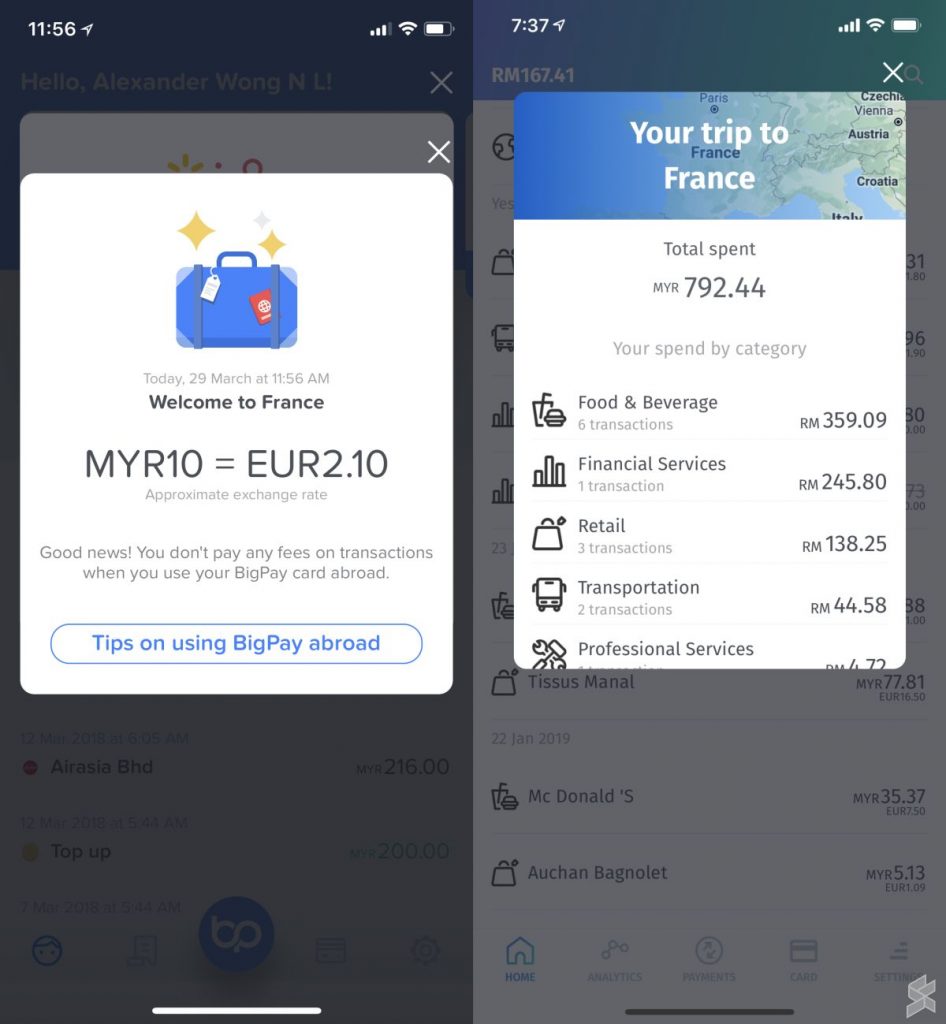

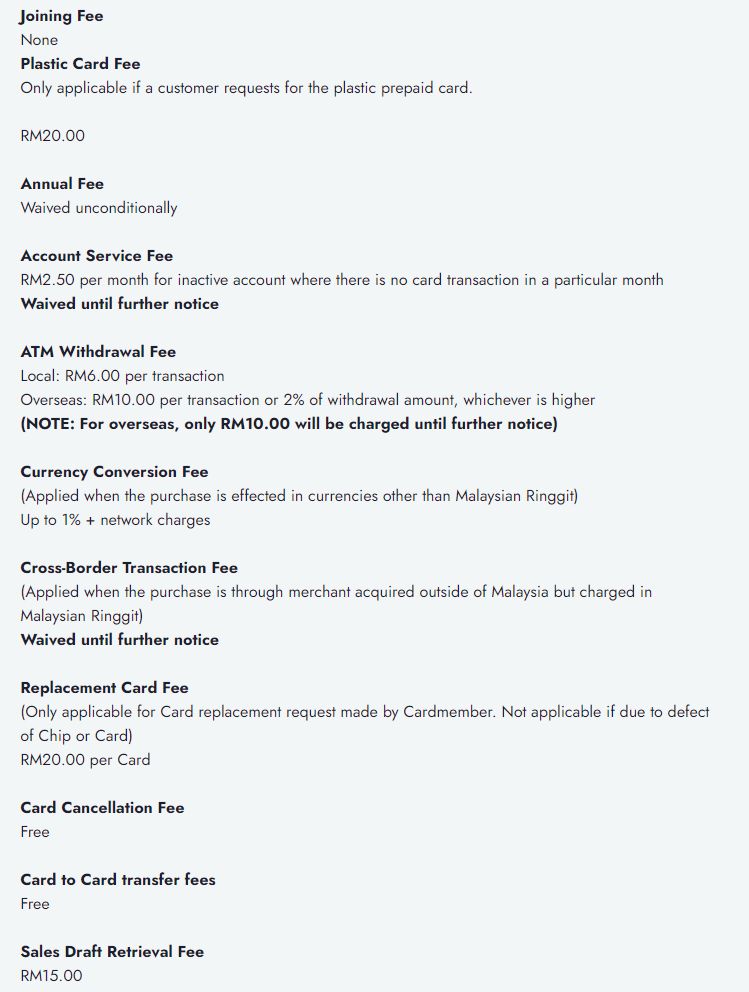

First on the list is BigPay, which is a prepaid card from AirAsia. It’s free to sign up from the app and it comes with a virtual prepaid card. If you want the physical card with paywave, it is no longer free and you’ll have to pay RM20 for it.

After completing the eKYC verification process, you can get a maximum wallet size of up to RM20,000. You can top up the card via online banking or even with a credit card. Take note that BigPay will charge a fee of 1% if you top up more than RM1,000 a month via credit card.

With the physical card, you can use it at practically any card terminal that accepts Visa paywave or chip and PIN. You can also use it to withdraw cash which costs RM6 at local ATMs or RM10 for international ATMs under the Visa network.

On top of that, the BigPay app also supports QR payment via DuitNow QR. As announced recently, you can use it to scan and pay overseas with Singapore NETS, Indonesia QRIS or Thailand’s PromptPay QR code.

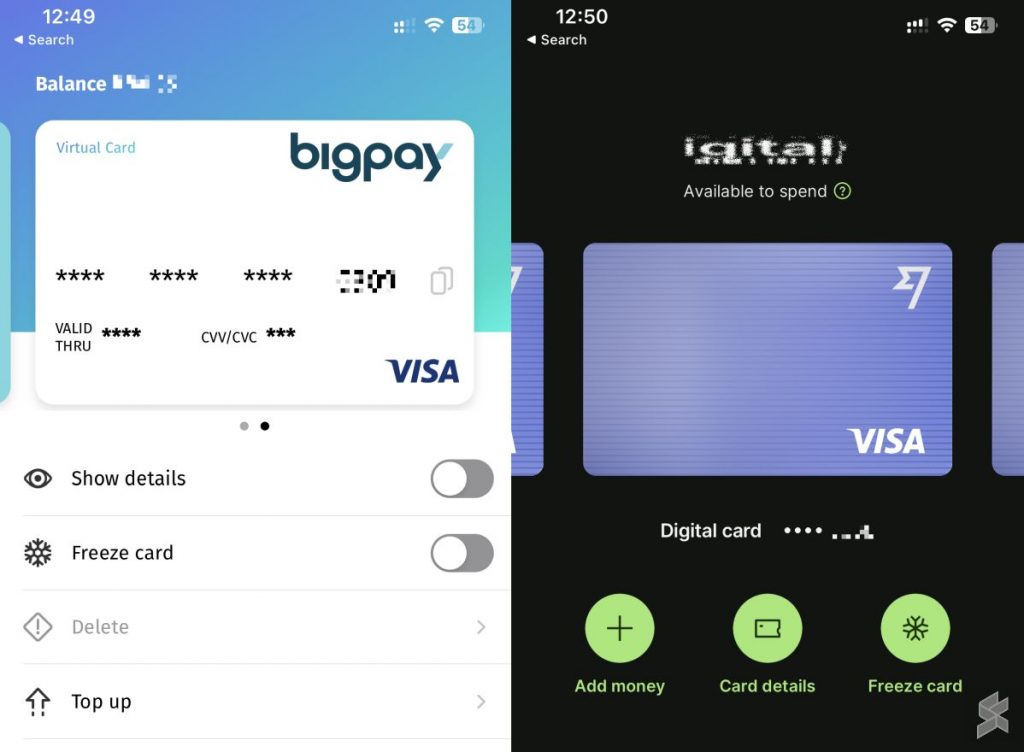

The BigPay app is pretty sleek and straight forward and it provides a pretty good interface to monitor your overseas spending. You can also manage your card from the app including freezing the card so that no transactions can go thru if your card goes missing.

Learn more at BigPay’s website.

Touch ‘n Go Visa Prepaid

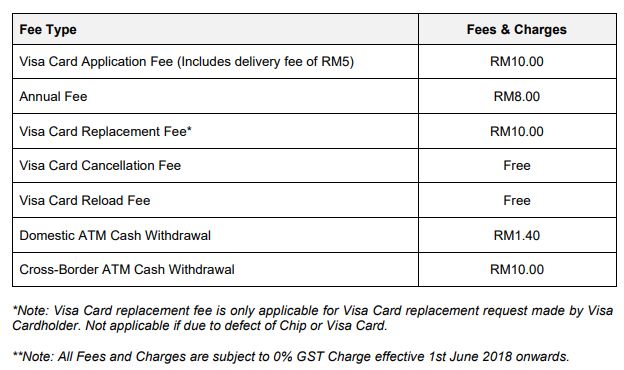

Next is the Touch ‘n Go Visa Prepaid card which is linked to your Touch ‘n Go eWallet. This is great if you want to use your TNG eWallet credit in locations where QR code payments including DuitNow QR are not accepted. Similar to BigPay, you can use it anywhere where Visa is accepted including Paywave and Chip and Pin. At the moment, the physical card costs RM10.

Since the card is linked to your TNG eWallet, you can reload it via credit card. However, Touch ‘n Go has started charging a 1% fee for credit card reloads of more than RM1,000 a month if you need to transfer funds to other accounts. Once you’ve completed the TNG eWallet eKYC process, you can technically have a maximum wallet size of RM20,000.

The Touch ‘n Go Visa Card is also the first card in Malaysia to be numberless. So even if you lose the card, nobody can steal your card details for online transactions. The Visa card can also be used for ATM withdrawals. The fees are RM1.40 for local ATMs and RM15 for international ATMs under the Visa network.

Learn more at Touch ‘n Go Visa page.

EnrichMoney Visa Prepaid

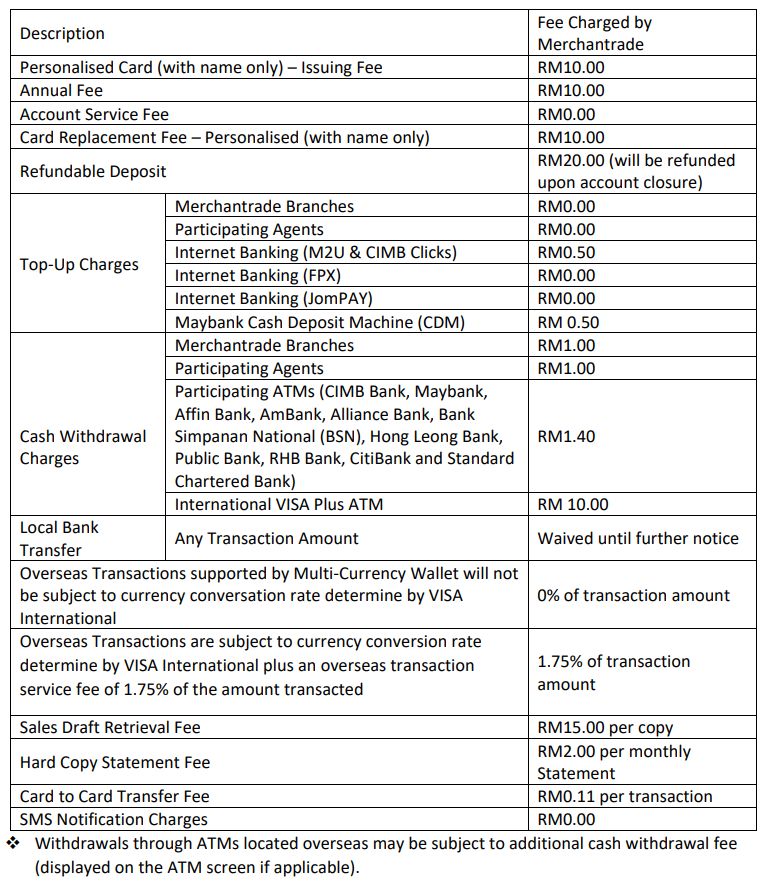

Malaysia Airlines also has its own travel-oriented prepaid card called EnrichMoney. This card is offered in partnership with MerchantTrade which has been offering its own multi-currency wallet which supports 20 currencies such as USD, SG Dollar, Australian Dollar, British Pounds, Euro, Chinese RMB, Thai baht, and more. So you can exchange your money to your preferred currency and spend that amount overseas.

The only thing is during sign-up, you need to make a minimum reload of RM100 and RM40 will be deducted. RM10 is for the physical card fee, RM10 for annual fee and another RM20 will be held as a refundable deposit. This means your balance is only RM60 after the initial RM100 top-up. Unlike BigPay, there’s no separate virtual number. But EnrichMoney also has a maximum wallet size of up to RM20,000.

For ATM withdrawals, it costs RM1.40 for local ATMs and RM10 for international ATM withdrawals.

Learn more at EnrichMoney’s website.

Wise Visa Prepaid

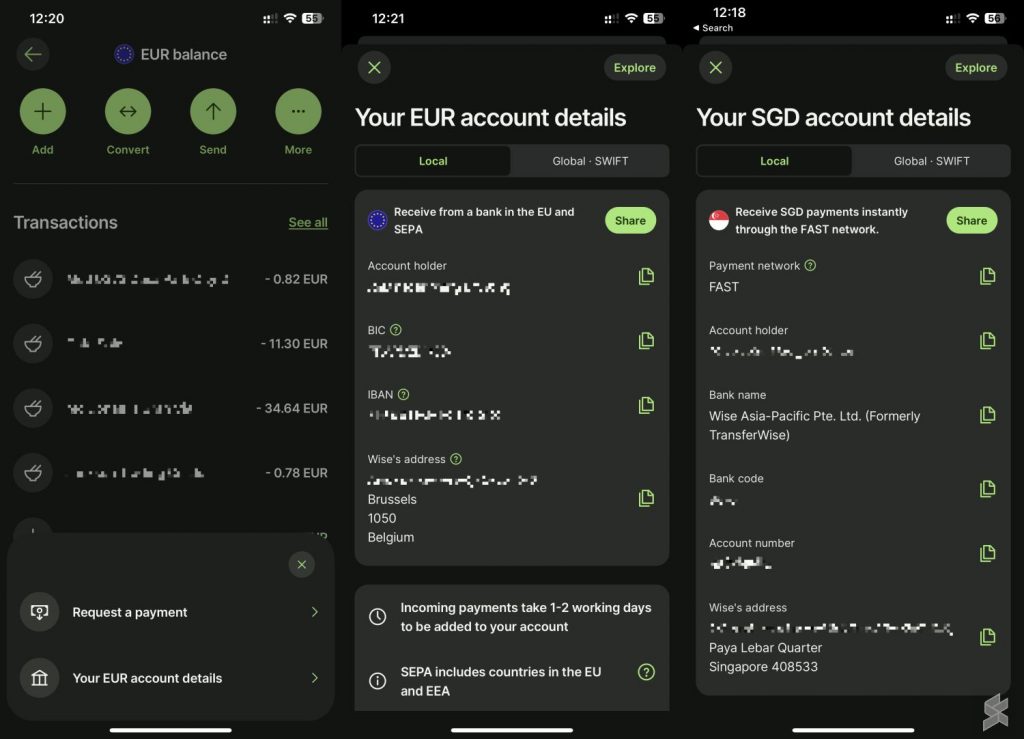

Wise is also another multi-currency wallet but it offers so much more. Besides having the ability to exchange and top up different currency wallets, Wise also allows you to receive money like a local in certain countries. For selected foreign currency wallets, it even provides “local bank account” details which allow you to receive money like a local. However, the transaction might take a few days to be added to your account.

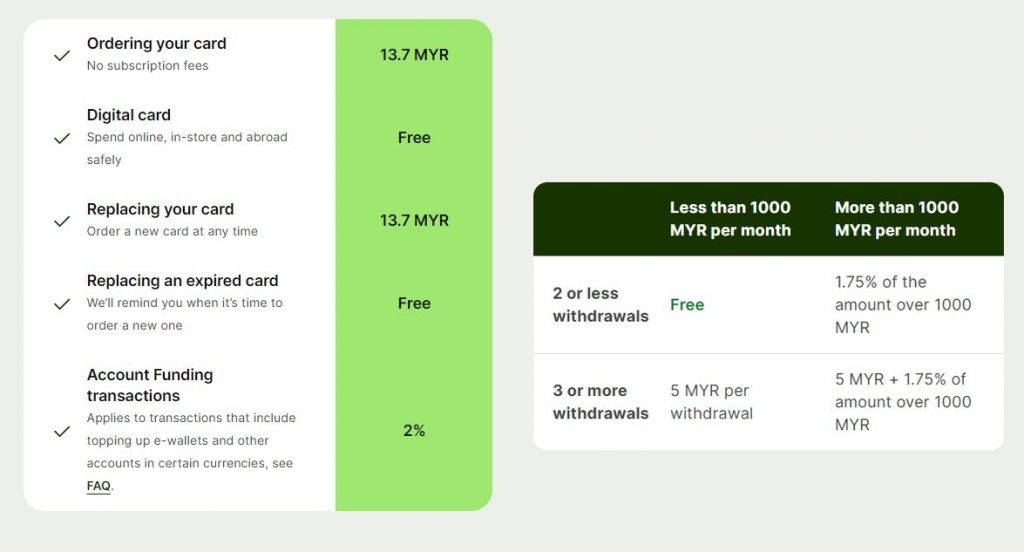

To create a new Wise account, you’ll need to top up a minimum of RM101. Yeah, RM101, for some strange reasons there’s that extra RM1. And if you need the physical card, it will cost you RM13.70.

Another benefit for Wise is you can create up to 3 virtual card numbers which is fantastic. You can have 3 additional cards that you can use for digital spending such as eCommerce, transportation and amusement park tickets. If there’s a security breach with one of the digital platforms that saved your card, you can easily cancel or change your virtual card without replacing your physical card.

Another perk of Wise is that it charges just RM5 per ATM withdrawal and the first two ATM withdrawals are free if it is less than RM1,000 in a month. For any withdrawal of more than RM1,000 per month, Wise will then charge an additional fee of 1.75%.

Learn more on Wise’s website.

MAE Visa Prepaid

The fifth and final recommendation on our list is MAE by Maybank. Essentially, this is Maybank’s digital bank offering which lets you create an eWallet with a linked debit card.

MAE lets you view your account balance in the local currency with its auto currency conversion feature. However, it only has a maximum wallet size of RM10,000.

The card costs RM8 per year which lets you make unlimited local withdrawals from Maybank ATMs. For international withdrawals, the fee is RM12. Another perk is that MAE supports both Apple Pay and Samsung Pay for a more convenient way to make contactless payments with your iPhone or Apple Watch.

Learn more at MAE’s website.

Summary

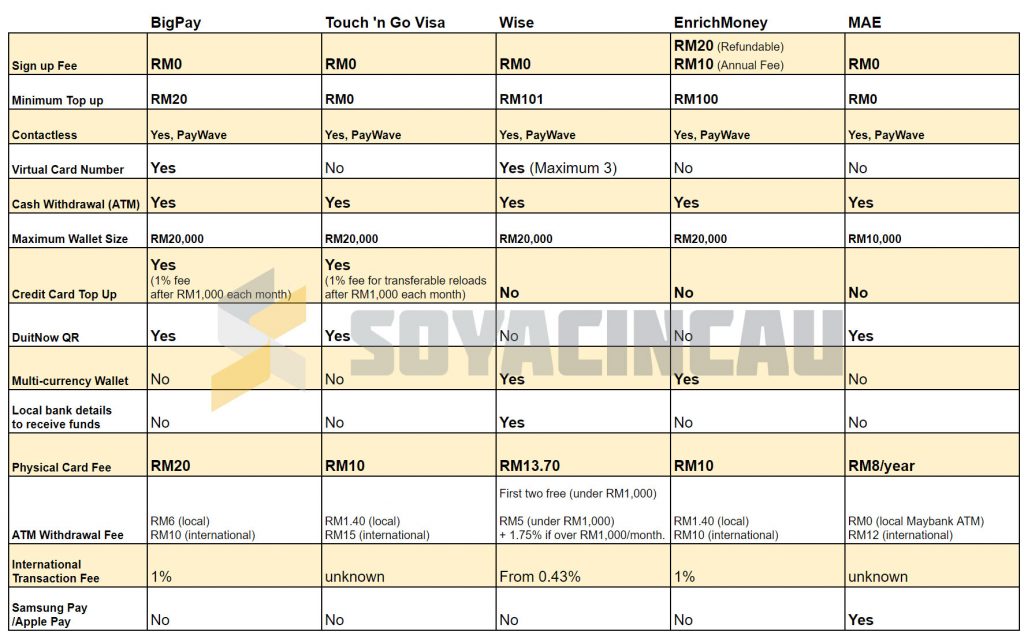

Here’s a quick summary of key features between BigPay, Touch ‘n Go Visa, EnrichMoney, Wise and MAE.

Take note that some cards offer extra rewards for your spending. For example, BigPay lets you earn 1 AirAsia Big Point for every RM30 spent and you can use it as a rebate for your next AirAsia flight. Meanwhile, EnrichMoney lets you earn EnrichMoney Points (not to be confused with Enrich Points) which range between 1 EnrichMoney Point for every RM20-30 spent and it is used for “cashback” for post-transactions.

These prepaid card providers may change their terms and conditions from time to time. So, it is best to refer to the respective product disclosure sheet for the latest rates and fees.

Travel Tips for spending overseas

Here are a couple of tips when using your card overseas. Firstly, if the card terminal asks you to select the currency, always select the foreign currency, don’t select MYR. In most cases, the MYR rates from the foreign provider are a lot more expensive, so if you’re in Europe, select EUR.

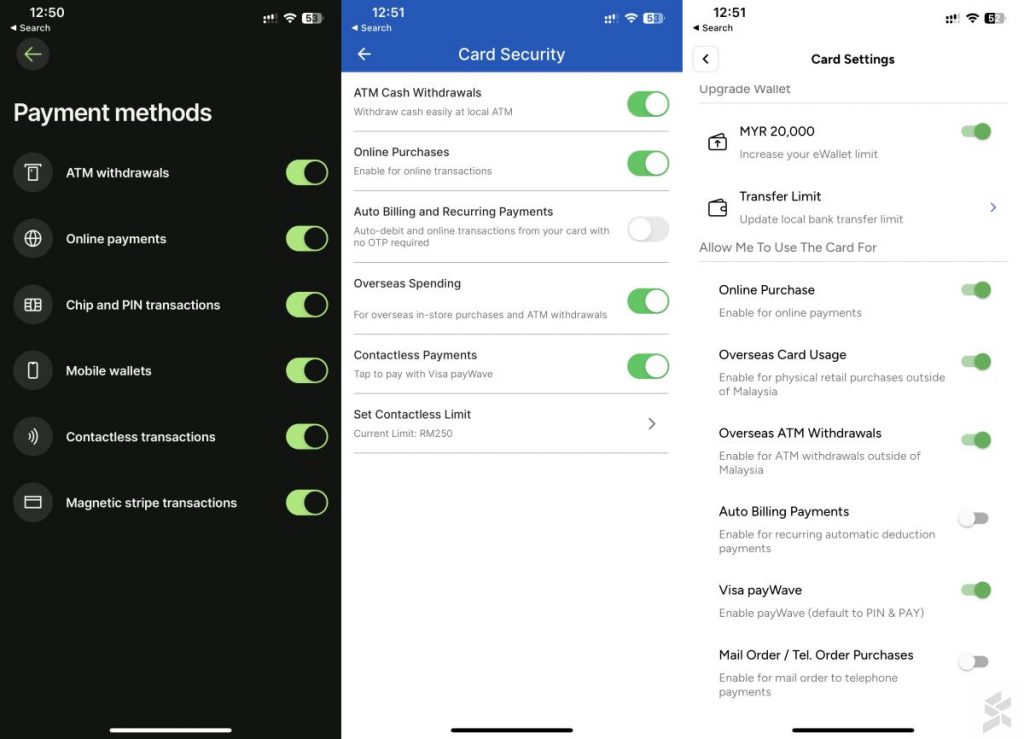

Second, monitor your transaction from the app. If you lose your card, you can freeze it immediately to block transactions. This is much easier than calling your bank to suspend the card and you don’t need to incur expensive roaming call charges. For better control, you can also disable online payments, ATM withdrawals, overseas spending and even change your PIN number on the app.

Third, if you gonna use the card for online payments, use the virtual number as much as possible. If a certain website suffers a data breach, you can easily replace the virtual number, without changing your physical card. This makes it less of a hassle and you don’t need to wait for a replacement card.

If you need to stay connected overseas, you might need a roaming plan for your phone. In case you missed it, here’s our list of best roaming plans offered by Malaysian telcos.

0 comments :

Post a Comment