In case you missed it, Malaysians travelling to Singapore can now use their preferred mobile banking or eWallet app to scan the Singaporean NETS QR code when making payments down south, with Singaporeans able to do the same when in Malaysia with our own DuitNow QR. Here’s a quick look at everything you need to know about the new cross-border QR payment system.

What is it?

The Bank Negara Malaysia (BNM) and the Monetary Authority of Singapore (MAS) have now formally announced the launch of the cross-border QR code payment linkage between the two countries. This payment linkage will allow both Malaysians and Singaporeans to use their own local banking and eWallet services to scan both the Malaysian DuitNow QR and Singaporean NETS QR payment codes.

It’ll work for both in-person payments through the scanning of the physical QR code, as well as online cross-border e-commerce transactions. The DuitNow-NETS QR payment linkage comes as a result of the Project Nexus plan being carried out by BNM and Payment Network Malaysia Sdn Bhd (PayNet). The Malaysia-Singapore bilateral cross-border payment linkage becomes the third one Malaysians can use, following earlier payment linkages set up between Malaysia-Thailand and Malaysia-Indonesia.

According to BNM governor Tan Sri Nor Shamsiah Mohd Yunus, this cross-border QR payment linkage between Malaysia and Singapore is a significant step in building an ASEAN network of fast, efficient and interconnected retail payment systems. His Monetary Authority of Singapore counterpart Ravi Menon added that the linkage will also work to boost cross-border commerce and allow small businesses in particular to tap into a wider pool of consumers.

“The QR linkage between Malaysia and Singapore will benefit millions of commuters across the Causeway as well as business and leisure travellers. It will also be a boost to retail businesses in both countries.

We will continue to work closely with our partners to accelerate our digitalisation agenda towards increased regional economic and financial integration,” – Tan Sri Nor Shamsiah Mohd Yunus, Bank Negara Malaysia governor

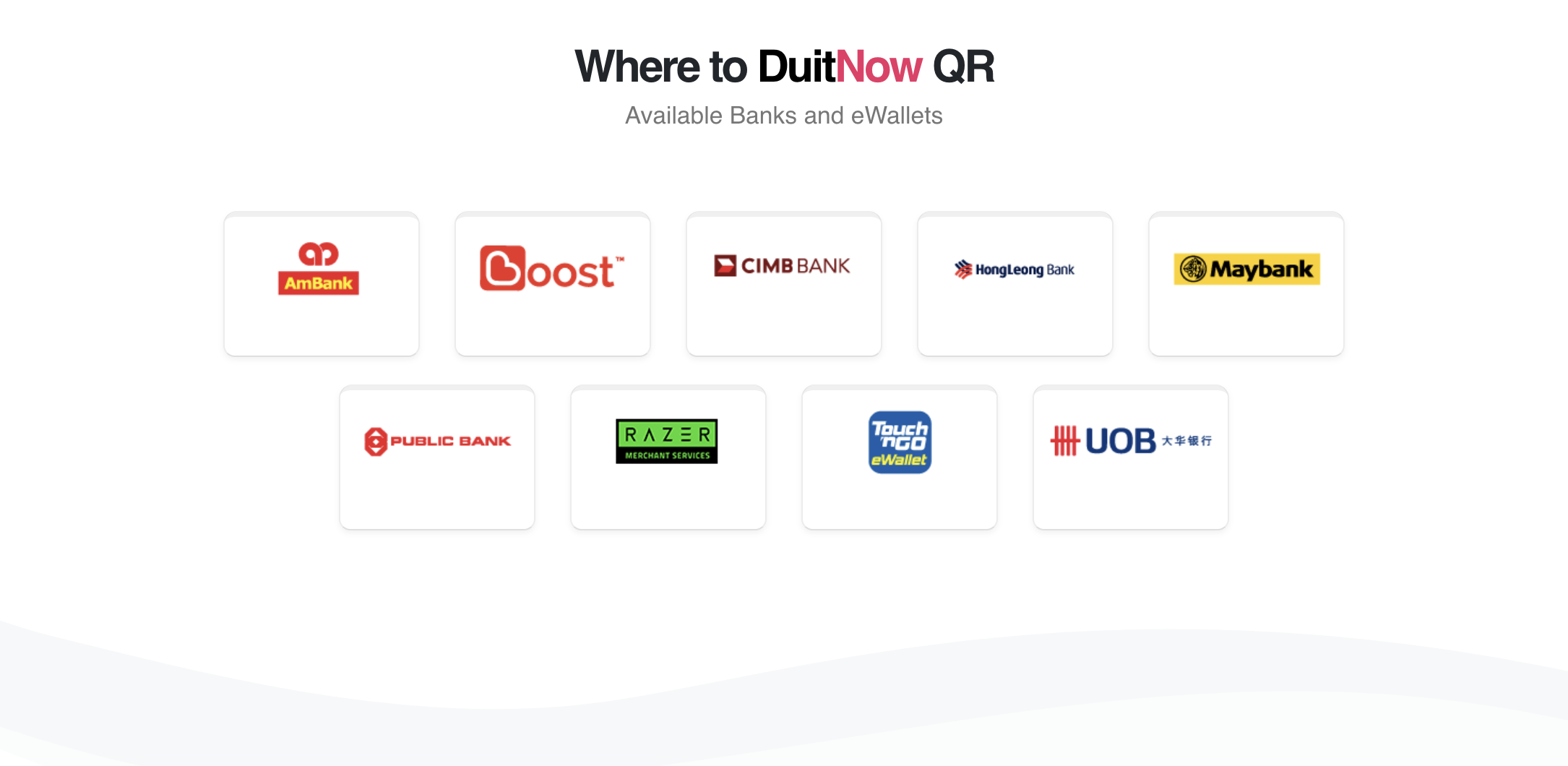

What banking apps and financial services are supported?

At the moment, Malaysian banks and financial services that you can use while in Singapore include:

- AmBank Malaysia Berhad

- Boost

- CIMB Bank Berhad

- Hong Leong Bank Berhad

- Malayan Banking Berhad

- Public Bank Berhad

- Razer Merchant Services Sdn Bhd

- TNG Digital Sdn Bhd

- United Overseas Bank Malaysia Berhad

Meanwhile, Singaporeans who travel across the straits to Malaysia will be able to pay via DuitNow QR as long as they use DBS Bank, OCBC Bank or UOB.

How do you use it?

If you’re in Singapore, you’ll be able to use any of the aforementioned apps and services to pay for stuff at participating merchants as long as you look out for the Singaporean NETS QR code. According to the NETS website, at most hawker centres, coffee shops and canteens, there ought to be a printed NETS QR or SGQR label near the cashier. At most other retail stores and merchants meanwhile, it’ll either be displayed on the terminal screen or on the printed receipt.

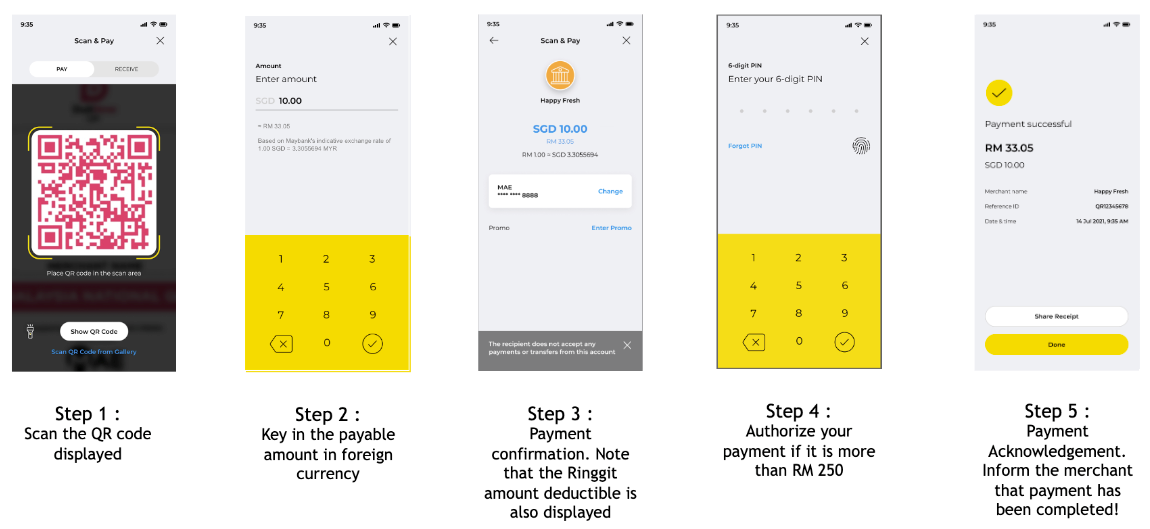

The specifics will be slightly different depending on which app you use, but for the most part the payment process will be the same. All you have to do is open up your payment app and scan the NETS QR code with your smartphone, enter in the amount needed to make the payment and once it’s done you can then show the confirmation screen to the merchant.

Taking Maybank for example, you’ll need to use the MAE app to scan a NETS QR code while in Singapore. Then, you’ll need to key in the payable amount in SGD, and after that you’ll get a confirmation screen showing both the SGD amount and the Ringgit amount too. You may need to then authorise the payment if it’s more than RM250. Once that’s done, you’ll be shown the payment acknowledgement receipt, after which you can show the merchant.

Can you make P2P eWallet to eWallet transfers?

At the moment, cross-border account-to-account fund transfers and remittances via DuitNow and Singapore’s PayNow is not yet available. However, BNM and MAS are already working on expanding the payment linkage to enable cross-border account-to-account fund transfers and remittances soon, allowing real-time fund transfers between Malaysia and Singapore for user convenience with just the recipient’s mobile phone number using DuitNow and PayNow. They expect this service to go live by the end of this year.

0 comments :

Post a Comment