Communications and Digital Minister Fahmi Fadzil has told Parliament that the latest Mandatory Standard on Access Pricing (MSAP) will further reduce the price for wholesale high-speed broadband access to retail broadband players, leading to more competitive pricing with higher speeds for consumers. The Malaysian Communications and Multimedia Commission (MCMC) released its determination on the MSAP on 16th February 2023 and it takes effect on 1st March 2023.

In a nutshell, the MSAP sets the wholesale pricing for various telecommunications services. When the 2018 MSAP was introduced during Gobind Singh’s tenure as Communications and Multimedia minister, Malaysians were able to enjoy even faster fibre broadband speeds up to 1Gbps at reduced prices, while the baseline broadband speed has jumped from 5Mbps to 30Mbps.

New MSAP cuts wholesale HSBB access pricing by half

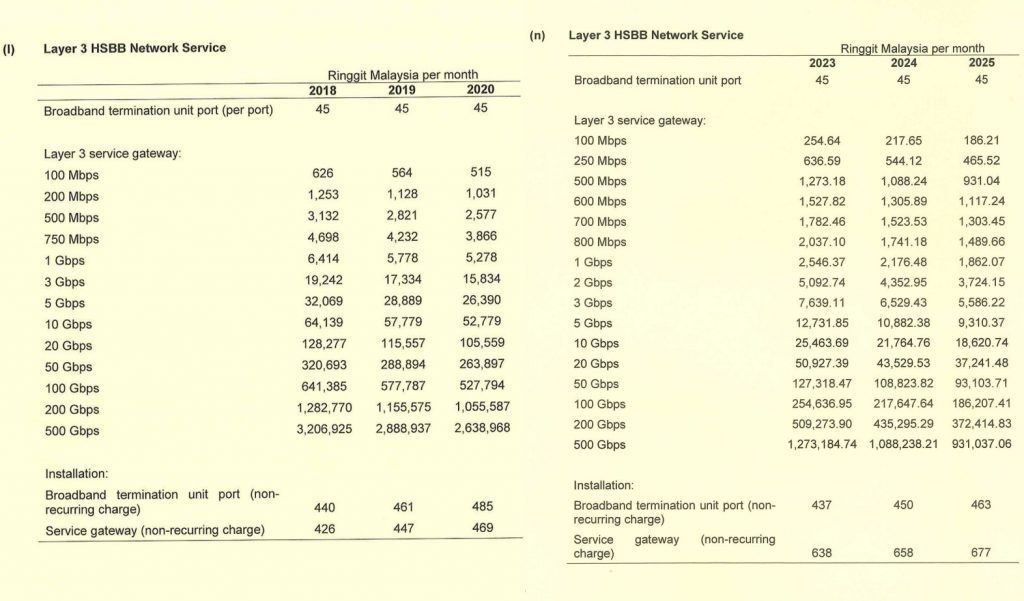

Fahmi said, for example, the wholesale price for 100Mbps Layer 3 HSBB used to cost RM515 per month based on 2020 rates will now cost RM254.64 per month in 2023 as listed in the latest MSAP document. That’s a reduction of about 50% on monthly access fees for retail broadband players.

Responding to a question by Kota Melaka MP Khoo Poay Tiong during Minister’s Question Time at Dewan Rakyat, the minister said, as such, it will reduce the cost to the recipient of access services involved in providing fixed broadband services to consumers. Indirectly, services provided to consumers at the retail level can be offered at a lower and more competitive price or at a higher speed.

The MSAP sets the maximum access prices for 14 facilities and services for the period of 2023, 2024 and 2025. Due to the pandemic, there was no revisions on access pricing for 2021 and 2022.

For new fibre installation, the cost of broadband termination unit (BTU) port has been revised down slightly from RM485 in 2020 to RM437 in 2023. However, the one-time cost for service gateway has increased from RM469 to RM638. Meanwhile, the reoccurring access pricing for broadband termination unit (BTU) port remains unchanged at RM45 per month.

Telekom Malaysia (TM) is expected to face the biggest impact on its earnings as other access seekers that tap on TM’s HSBB network such as Celcom, Digi, Maxis and Astro, will pay lower wholesale prices in order to offer commercial fibre broadband services to consumers.

Fahmi said in 2017, TM recorded a net profit of RM730.5 million but it suffered a loss of RM260.5 million after the MSAP is implemented in 2018. However, TM managed to bounce back a year later with a net profit of RM557.4 million in 2019 and continues to increase with a net profit of RM1.14 billion recorded for 2022. Fahmi said this shows the “Malaysia Boleh” spirit in TM even when given challenges, they are able to rise again.

In case you’re wondering why the wholesale price for 100Mbps costs more than retail pricing, broadband providers only subscribe to wholesale access based on the total peak network usage, not based on the accumulative total bandwidth “sold” to its customers. For example, if there are 1,000 customers subscribed to 100Mbps, the retail provider isn’t going to sign up for 100Gbps per month. The reality is that not all customers will maximise their total subscribed bandwidth all at the same time.

Hopefully, we might see lower pricing for the base broadband plan from all fibre broadband providers in the coming months. Realistically, we reckon that fibre broadband providers would introduce more competitive deals for the higher bandwidth plans (300-800Mbps) considering they will have more headroom with the new reduced prices.

No MSAP for 5G?

Besides fibre, a noticeable omission is a mandatory standard on access pricing for 5G wholesale access. At the moment, DNB’s published Reference Access Offer (RAO) for 5G access pricing starts from RM30,000 per Gbps per month that’s locked to a 10-year contract duration. DNB has said it is open to conduct a price review every 18 months either via an independent party or through the MSAP.

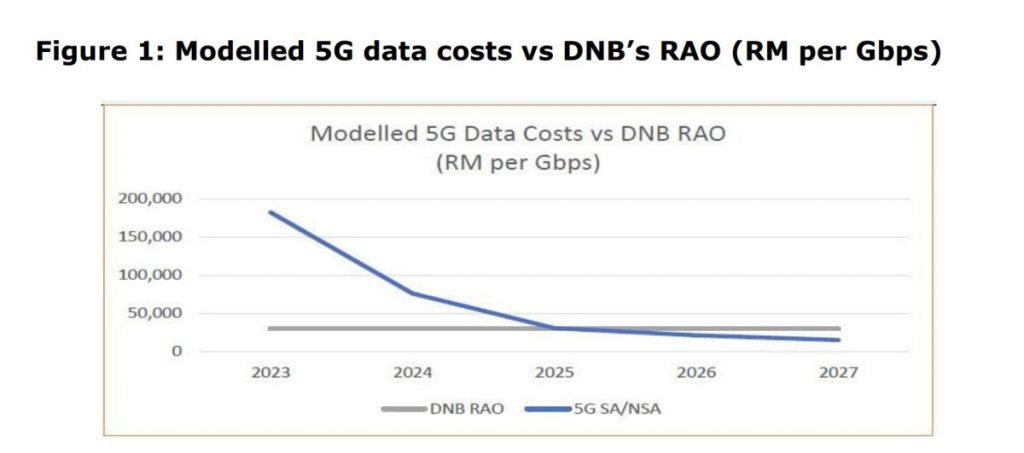

According to the Public Inquiry on the MSAP published last month, MCMC’s modelled 5G data cost would be at least 5x higher than DNB’s current rate at over RM150,000 per Gbps for the first year. However, the 5G wholesale pricing will gradually decline significantly in the coming years and it will be much lower than DNB’s rate from 2026 onward in tandem with more users migrated from 4G to 5G.

While DNB agree that Long Run Incremental Cost (LRIC) approach can help ensure cost efficiencies in network investments, it believed that the MCMC’s bottom-up LRIC with common cost mark-up approach was not appropriate for setting regulated prices. DNB stated that the model will inevitably overlook certain costs, as it uses a scorched node approach which ignores real-life considerations and wrongly assumes that DNB’s network grows linearly.

DNB disagrees with the calculation used by the MCMC to sets the 5G price caps and suggested that the regulator to consider other alternative calculations for price caps. Since retail telcos have started paying DNB for 5G access, some of them have started tightening their Fair Usage Policy (FUP) and announced plans to charge consumers a monthly fee to access the national 5G network.

You can check out the latest 2023 MSAP here and the previous 2018 MSAP here.

0 comments :

Post a Comment