The current pandemic has accelerated the adoption of cashless transactions with QR codes being used as the preferred method. These days it is common to see shops showing various QR codes from every provider but this may soon be a thing of the past with DuitNow QR.

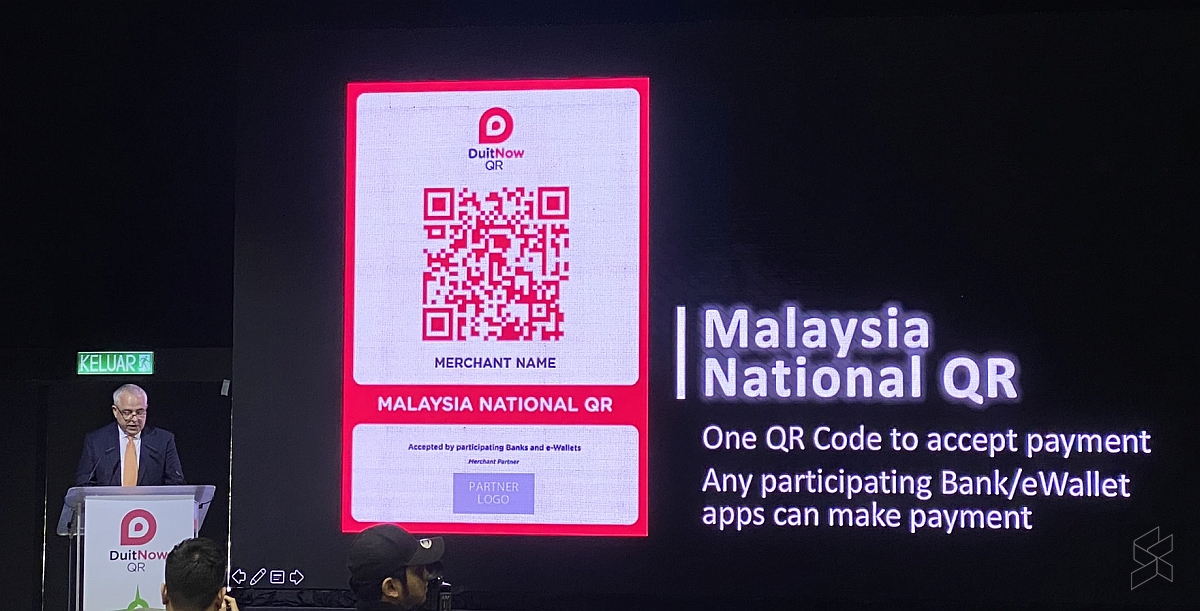

DuitNow QR by PayNet is Malaysia’s national QR code standard and it’s supposed to be the one QR code that merchants would ever need to accept payment from banks and eWallet providers.

To recap, PayNet is Malaysia’s financial market infrastructure provider that’s formed with Bank Negara Malaysia as its biggest shareholder along with 11 Malaysian banks. Apart from DuitNow, PayNet is also the enabler for interbank GIRO, MEPS, FPX, MyDebit and JomPAY services.

The benefit of DuitNow QR is that businesses can register with just one financial provider and display one QR code that’s recognised across different eWallet and online banking apps. As a result, shops wouldn’t need to register multiple merchant accounts with different eWallet providers and they can view all of their QR-code based transactions from a single statement issued by their preferred acquirer.

As of January 2021, there are a total of 26 participants which are integrated into the DuitNow QR network. This include Maybank, AmBank, Hong Leong Bank, HSBC, OCBC, RHB, Public Bank, CIMB, Alliance, Standard Chartered and UOB.

Among the listed providers, ShopeePay appears to be the first and only eWallet to support DuitNow QR, despite being a new entrant into the digital payment scene. The other popular eWallet providers such as Boost, BigPay, GrabPay, Touch ‘n Go eWallet and FavePay are still listed as “launching soon” on DuitNow QR’s website. It’s also worth pointing out that Grab was the first eWallet to announce its support for DuitNow QR in November 2019.

According to PayNet, they are expecting 15 new banks and eWallets to be added progressively to the network over the next 6 months. Interestingly, PayNet had said about a year ago that four eWallet providers will be supported by mid-2020. To find out what’s going on, we’ve reached out to Boost, Grab and Touch ‘n Go for an update.

GrabPay

According to a Grab, they are still committed to DuitNow QR but they had shifted its main focus during the MCO to help digitalise merchant-partners. They are still working towards launching its support soon and have shared that its planned integration is still on track but without giving a definitive timeline.

Below is the official statement from a Grab spokesperson:

As a homegrown tech enabler, we introduced GrabPay to provide consumers with a safe, convenient and seamless digital payments experience allowing them to pay for services on the Grab app and in-stores (payments to merchants). We are constantly innovating and exploring strategic collaborations with like-minded partners and the government to drive digital payment usage. This includes our successful collaboration with the government in the e-Tunai and ePENJANA initiatives that have furthered the adoption of digital payments in Malaysia.

However with the pandemic and various movement control, we had to focus our immediate efforts in supporting our merchant-partners to digitalise, while continuing to serve consumers who depended on Grab services since the first MCO last year. We are continuously working toprovide our merchants and users with the convenience and access to our robust ecosystem and services across our platform. Our strategy has always been focused on being hyperlocal and the planned DuitNow QR integration is still on track. We are working towards launching this soon and will announce when the system is fully up and running.

Boost

Boost, the eWallet by Axiata Digital, is still committed to the DuitNow QR initiative but with no live dates provided. When asked about their status, they have issued us the following statement:

Yes, we are definitely still supporting the national QR initiative. We are working very closely with PayNet towards ensuring we deliver the best possible interoperable digital payment experience for all users. We hope to go live soon, so please stay tuned for our launch announcement.

Touch ‘n Go eWallet

Similarly, Touch ‘n Go is still supportive of the unified QR code platform but without giving exact live dates. According to a spokesperson, Touch ‘n Go eWallet’s integration work has been fully completed. It added that the actual rollout will be done in phases and it will be announced accordingly.

Touch ‘n Go had previously targetted to go live by July 2020 and it will also tap into DuitNow’s extensive ecosystem. Apart from making QR code payments, Touch ‘n Go eWallet users could soon perform instant fund transfers to other eWallets and bank accounts via the DuitNow network.

Related reading

The post DuitNow QR: When will Boost, Grab and Touch ‘n Go eWallet support Malaysia’s unified QR code? appeared first on SoyaCincau.com.

0 comments :

Post a Comment