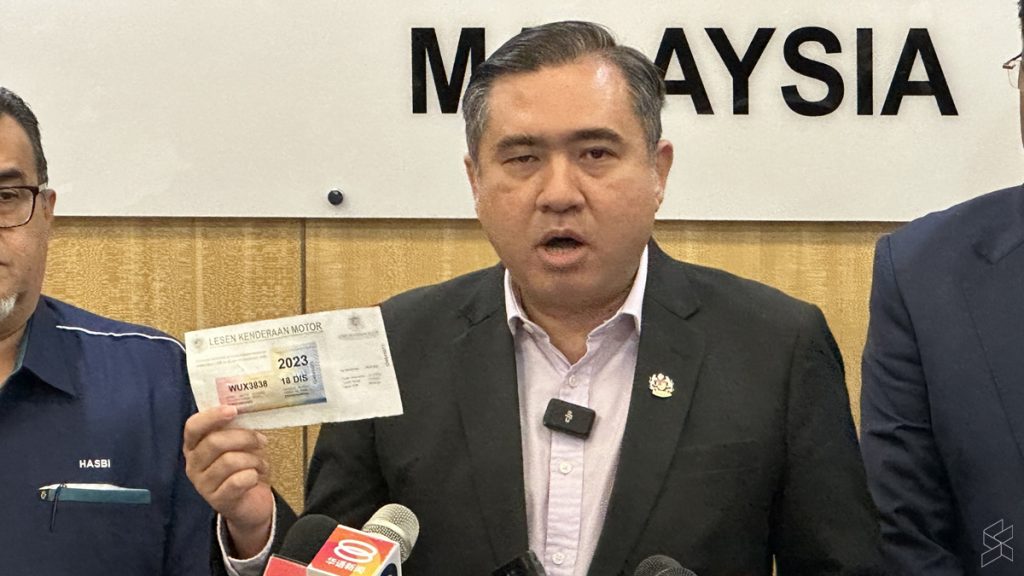

With the current road tax exemption for electric vehicles (EV) set to end on 31st December 2025, Transport Minister Anthony Loke said his ministry is currently working on a new road tax structure for EVs. He said the new structure was essential because the previous government had given road tax exemption for EVs only until 2025.

Anthony said the new road tax structure was expected to be unveiled at the end of this year and it would be featured prominently in the ministry’s Budget 2024 proposal.

As quoted by Bernama, Anthony said “Consumers are generally concerned about the EV road tax structure because if based on the old formula, the cost impact is high and can reach RM4,000 to RM5,000 a year.”

“I have directed officers at MoT to study this matter based on feedback from consumers and companies providing EVs. This is part of our efforts to encourage users to switch to this type of vehicle”, he added.

He said the policies on EV usage should be clear to facilitate efforts to migrate to a more sustainable transport mode as the country aims to achieve 15% total industry volume (TIV) for EVs and hybrid vehicles by 2030 and to have 10,000 EV charging points by 2025. Anthony added that Malaysia could leverage on Sweden’s best practices and expertise in EV adoption, charging infrastructure and smart traffic systems to accelerate the transition to eMobility in Malaysia.

Current road tax structure for EVs doesn’t make sense

At the moment, Malaysia’s road tax for EVs is calculated based on the power output (kW) of the electric motors versus engine capacity (cc displacement) for vehicles powered by internal combustion engines, and the differences create a clear disparity.

For example, a Hyundai Kona Electric e-Max or the BYD Atto 3 which has a 150kW (201hp) motor would cost RM903 annually for road tax under the current structure while the petrol-powered Hyundai Kona 1.6 N Line with a 1.6-litre turbo engine producing 195hp is only required to pay a road tax of RM90. That’s a difference of about 10 times despite having a similar power output between the EV and petrol-powered vehicles.

Meanwhile, owners of the Volvo XC40 or C40 with a 300kW (402hp) power output would have to pay RM4,503 in road tax under the current structure while the annual road tax for a larger and more expensive Mercedes-Benz S560e plug-in hybrid with a 3.0-litre V6 engine costs RM2,120.

At the moment, fully imported (CBU) EVs are currently fully exempted from import duty and excise duty until 31st December 2025. Meanwhile, locally assembled (CKD) EVs are exempted from import duty on components as well as excise duty and sales tax until 31st December 2027.

[ SOURCE ]

Related reading

- Budget 2023: New EV incentives that were not announced in Parliament, tax-free CKD EVs until 2027

- Neta V Malaysia: Cheapest EV in the country with 380km range priced under RM100k, plus RM10k discount

- Tengku Zafrul: Tesla required to install 50 Superchargers in Malaysia by 2026, at least 15 open to all EVs

- Proton now plans to accelerate introduction of EV models as early as 2025

0 comments :

Post a Comment