Touch ‘n Go eWallet (TNG eWallet) has updated its terms and conditions which will affect users who reload via credit card for the purpose of transferring funds. Last year, TNG eWallet introduced its transferable and non-transferable buckets which seems to be an attempt to curb users from cashing out their credit card reloads. Verified TNG eWallet users on the premium level are currently permitted to transfer reloads made by credit card up to RM5,000 per month. With the upcoming change which will take effect from 22nd March 2023, credit card reloads with be subjected to a monthly transferable limit of just RM1,000 per month.

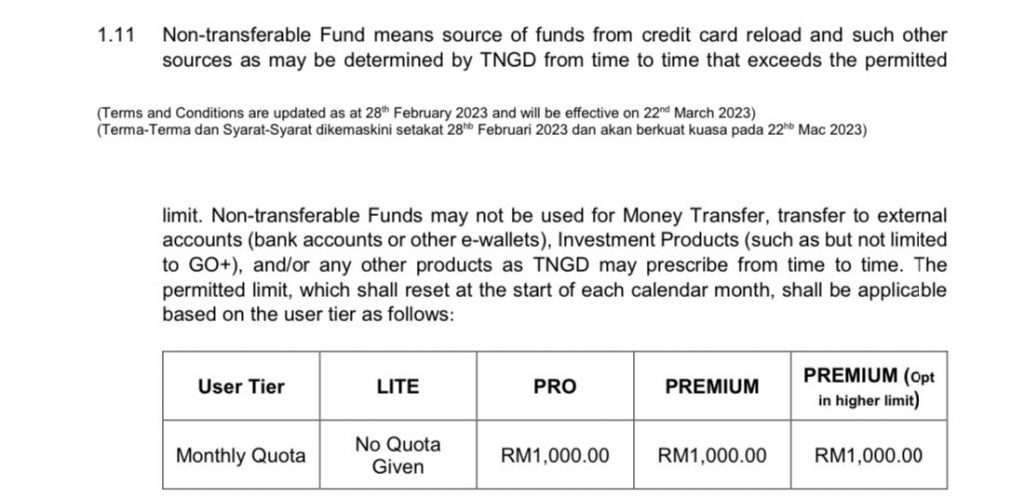

As stated in the new T&C, the monthly quota of transferrable credit card reload amount will be limited to just RM1,000 regardless if you’re a verified Pro or Premium eWallet user. However, if you really need to transfer more, TNG eWallet will still allow you to do so but they will impose additional fees.

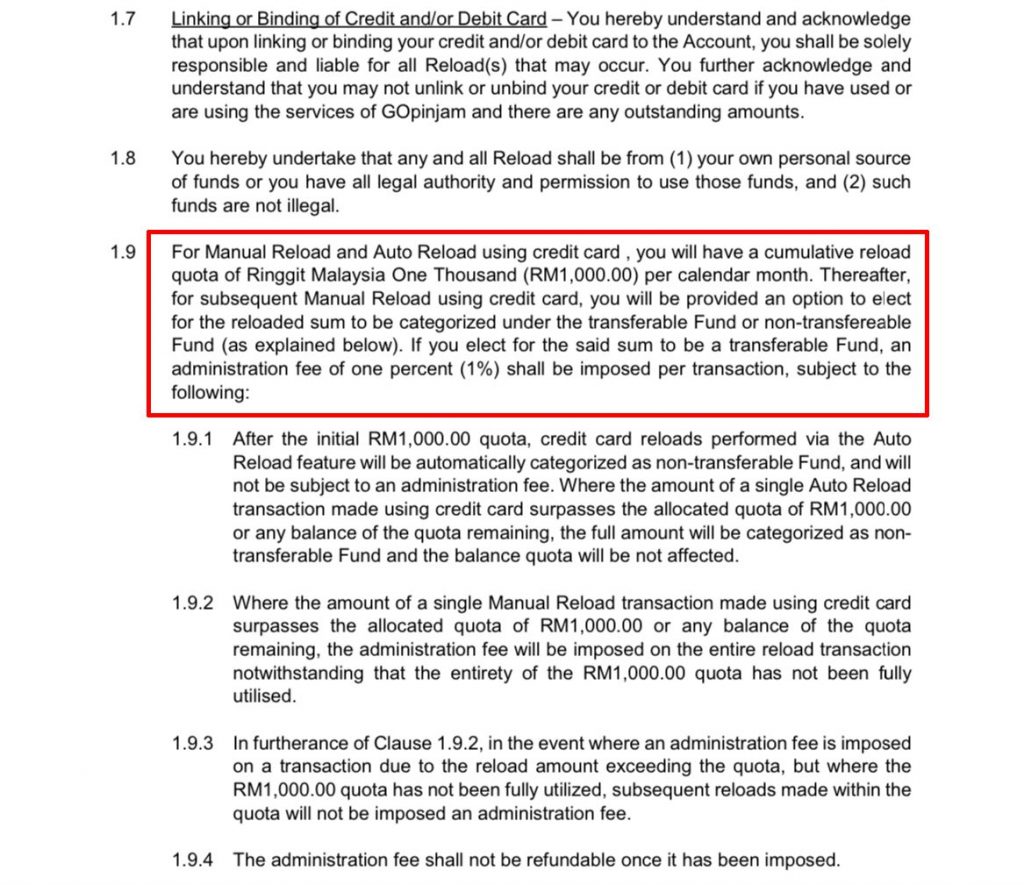

It is mentioned that once you’ve hit the accumulative RM1,000 per month limit, any subsequent manual reloads using credit cards will be provided with an option to choose the reloaded sum to be categorised as transferrable or non-transferable. If you choose transferable, TNG eWallet will charge you a 1% administration fee per transaction. This means an additional RM1,000 transferrable fund via credit card reload will cost you RM10.

It is mentioned that credit card reloads exceeding the RM1,000 quota conducted via auto reload will be categorised as non-transferable and you won’t be charged the 1% admin fee.

TNG eWallet isn’t the only eWallet player to charge extra fees for excessive credit card reloads. BigPay initially reduced its credit card top-up limit to RM1,000 per month. Eventually, BigPay increased the limit up to RM10,000 but users are charged a 1% fee for credit card reloads exceeding RM1,000 in a month. This is seen as a way to curb credit card cash-outs as users tend to use it to avoid paying high interest for credit card cash advances.

[ SOURCE ]

Related reading

- Touch ‘n Go eWallet now supports Face ID on the iPhone but it won’t work for payments

- You can now use Touch ‘n Go eWallet to pay for your Foodpanda delivery

- This is how Touch ‘n Go aims to address the confusion over TNG Visa card

- BigPay now lets you reload up to RM10,000 via credit card but you’ll have to pay a fee

0 comments :

Post a Comment