Ahead of this weekend’s MATTA Fair at MITEC, Malaysia Airlines has announced its new EnrichMoney Visa Prepaid Card powered by Merchantrade. Similar to AirAsia’s BigPay, EnrichMoney promises to offer attractive currency exchange rates for overseas spending as well as for remittance. Also included is a physical Visa Prepaid card which you can use at any merchant worldwide that accepts Visa and you can also withdraw money from Visa Plus-enabled ATMs.

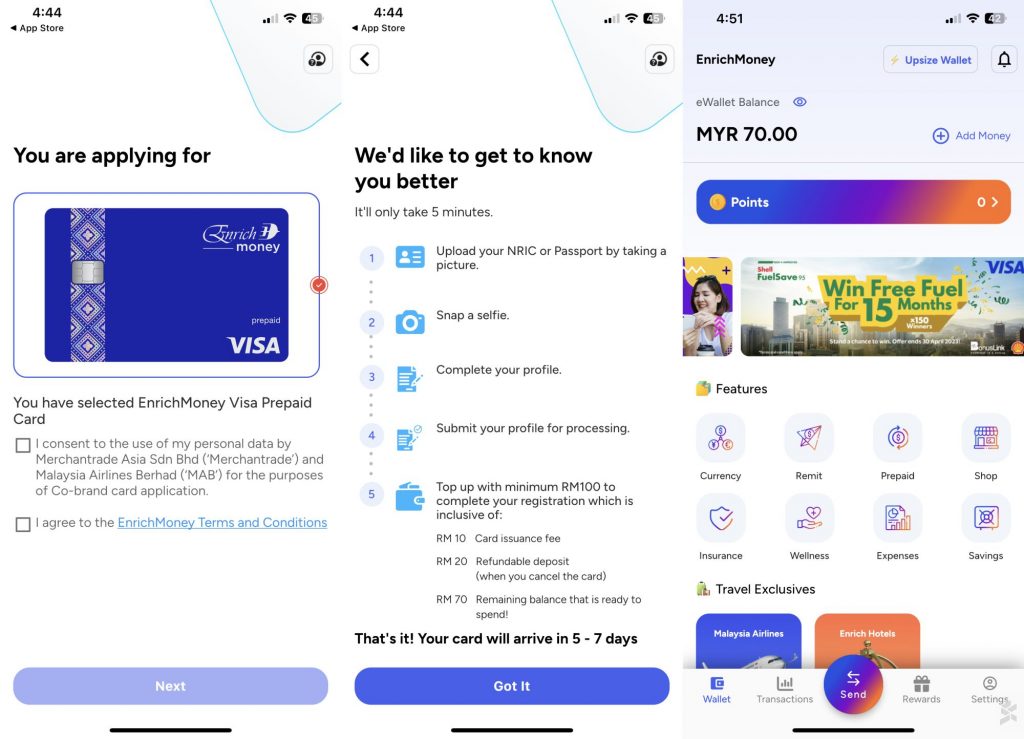

To apply for the Visa Prepaid card, you’ll need to download the EnrichMoney app which is available on both Apple App Store and Google Play Store. An Enrich membership is required and you can sign up for one during the application process. Like any new financial product, you’ll have to go through an electronic know your customer (eKYC) process which requires you to scan your IC and take a selfie photo of yourself.

During the registration process, you’ll need to make a minimum top-up of RM100 via online banking (FPX). Unlike BigPay, EnrichMoney doesn’t accept credit or debit card reloads. Take note that a total of RM30 will be deducted from your first top-up as RM10 will be charged for the issuance fee and RM20 as a deposit which will be refunded only when you cancel the card. This leaves just RM70 in your card balance after your initial minimum top-up. The physical Visa prepaid card will be delivered to your registered address in about 5-7 days.

EnrichMoney has its own reward system that’s called EnrichMoney Points which is different from Malaysia Airlines’ Enrich Points. Cardholders can earn EnrichMoney points with qualifying retail and online spending and it is used to pay for post-transactions. The earnings range between RM20-30 spent to earn 1 EnrichMoney Point.

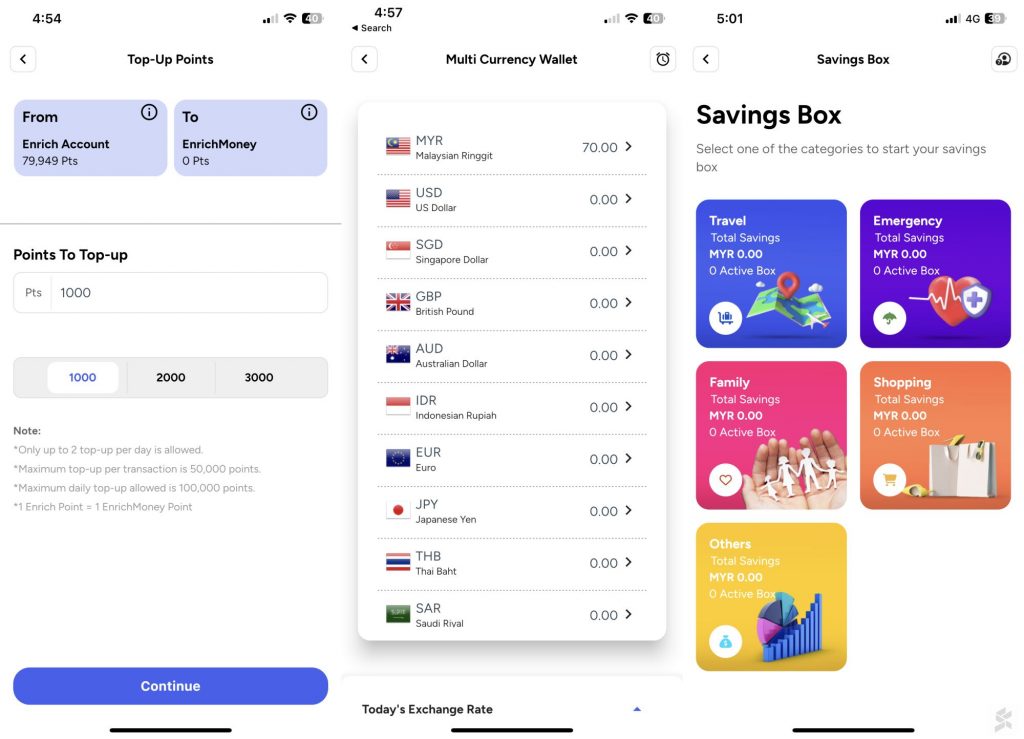

If you need more points to pay for your card’s post-transaction, you are able to top up points by converting your Enrich Points at 1 to 1 conversion. However, it doesn’t allow you to convert EnrichMoney Points back to Enrich Points.

One of the biggest highlights is the multi-currency wallet which lets you store your money in 20 different currencies including US Dollar (USD), Singapore Dollar (SGD), British Pound (GBP), Australian Dollar (AUD), Indonesian Rupiah (IDR), Indian Rupee (INR), Philippine Peso (PHP), New Zealand Dollar (NZD) and more. From the EnrichMoney app, you can view the current exchange rate or set alerts if there are major changes for preferred currencies. This feature is useful for international travellers as you can convert to certain currencies when the exchange rate is favourable and spend it later during your next trip.

Besides the ability to transfer funds overseas, the app also has a Savings Box feature which aims to help you save for different goals such as travel, shopping and emergencies.

EnrichMoney fees and limits

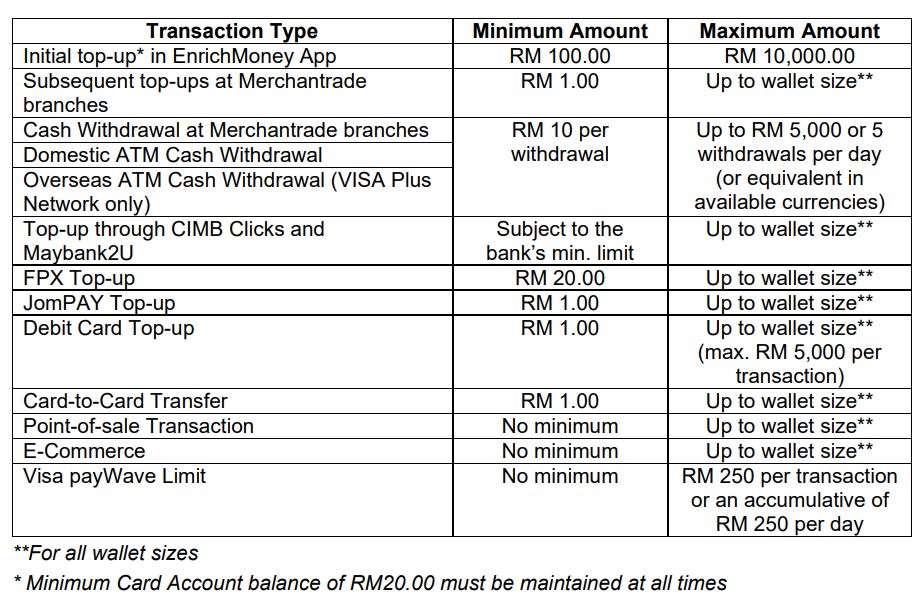

By default, the EnrichMoney has a wallet size of RM10,000 but there’s an option to upgrade it to RM20,000. However, you must have a minimum of 6 months of active transaction history and have an average eWallet balance of RM500 before making the Wallet size request.

The EnrichMoney Visa Prepaid card can be used for cash withdrawals at the ATM and there’s a transaction limit of 5 withdrawals per day with a daily limit of RM5,000, which is the same limit as TNG Visa Prepaid. The EnrichMoney Visa Prepaid card also supports Paywave contactless payment but there’s a limit of RM250 per transaction with an accumulative limit of RM250 per day. Users can top up their account up to the maximum wallet size with a minimum top-up of RM20 via FPX or RM1 via JomPay.

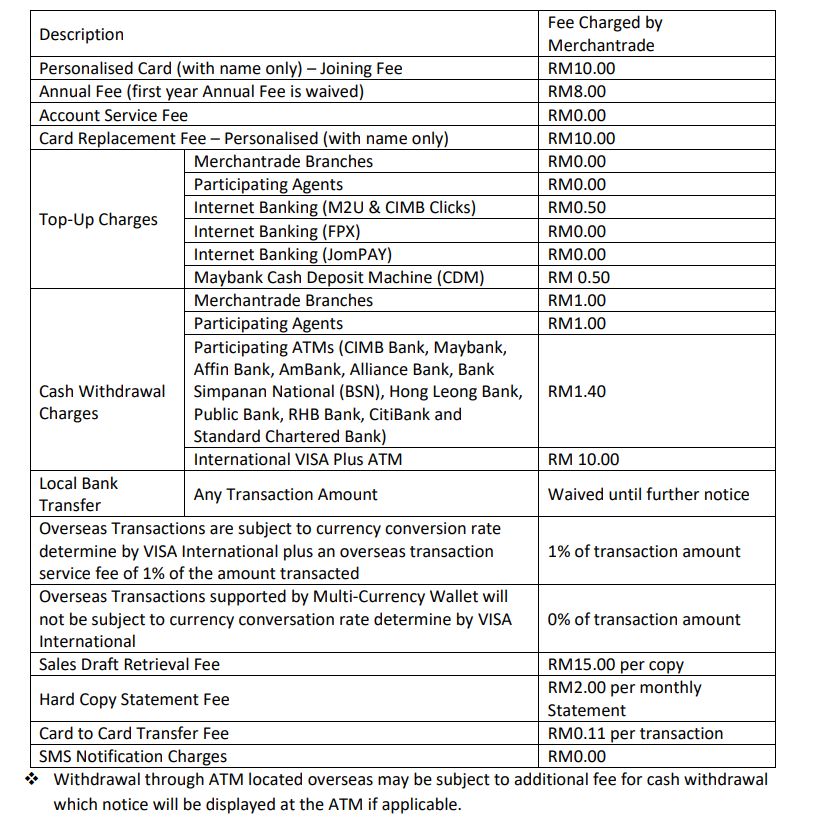

At the moment, the annual fee of RM8 is waived and a card replacement will cost RM10. If you need to withdraw cash, EnrichMoney charges RM1 at Merchantrade Branches and Participating Agents. If you withdraw cash from participating local ATMs, it will cost you RM1.40 per withdrawal while withdrawals made through International Visa Plus ATMs cost RM10. Meanwhile, fees for local bank transfers are waived until further notice.

It is also stated that overseas transactions are subject to a currency conversion rate determined by Visa international and there’s also an overseas transaction service fee of 1% of the amount transacted. However, overseas transactions supported by multi-currency wallet will not be subjected to currency conversion rates.

EnrichMoney Promo

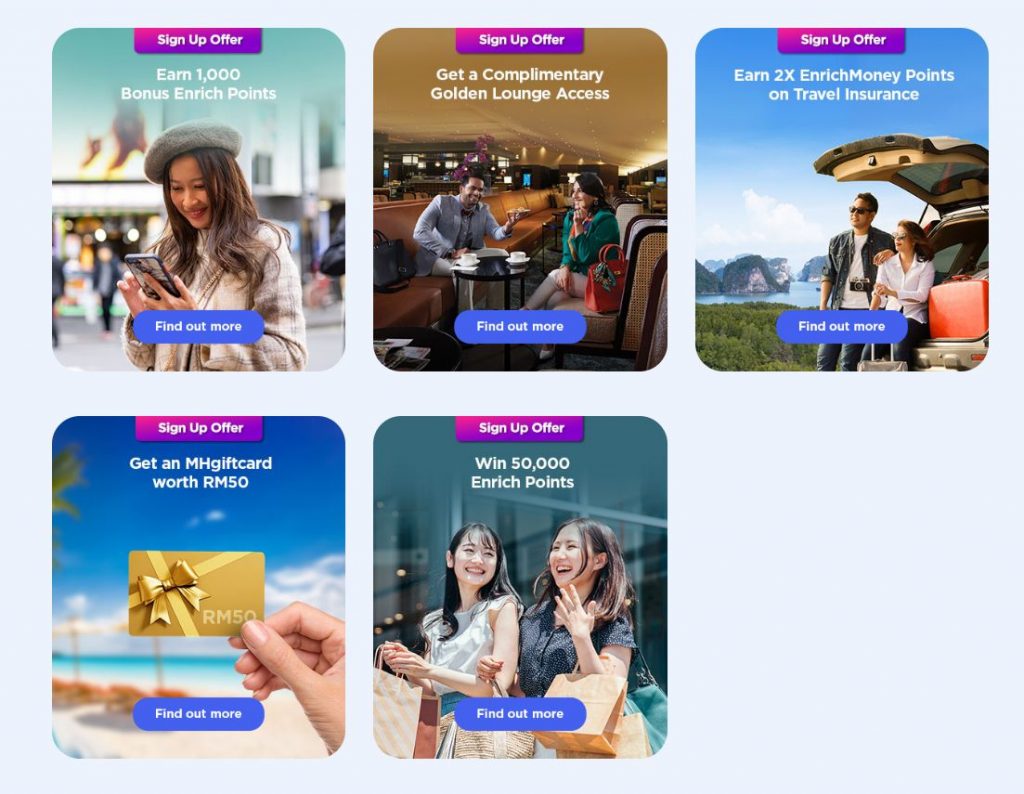

As part of their introductory promo, those who sign up for the EnrichMoney Digital money app with Visa Prepaid card will get one Malaysia Airlines Golden Lounge Access eVoucher that can be used for Domestic, Regional and Satellite Lounges for your next trip. They are also offering 1,000 Bonus Enrich Points for the first 10,000 registered users These promotions are running from 9th March until 30th June 2023.

To encourage card usage, EnrichMoney also offers RM50 MHGiftcard for the first 1,000 spenders to spend a minimum of RM3,000 and they are giving 50,000 EnrichPoints for the top 3 spenders by 30th June 2023.

You can learn more about EnrichMoney on their official website.

0 comments :

Post a Comment