The Malaysian government has recently announced a special Employees Provident Fund (EPF) withdrawal facility (Pengeluaran Khas) where contributors can take out RM10,000 from their retirement fund. This is to help individuals who are still struggling during the recovery phase of the pandemic. Applications are open starting 1st April through EPF’s special portal. Here’s everything you need to know.

Who is eligible for the RM10,000 EPF withdrawal?

According to EPF, the special withdrawal facility is open to all contributors aged below 55 years old. Besides Malaysians, it is also open to non-citizens as well as permanent residents. EPF members must have at least RM150 in their EPF account at the time of application.

If you’ve previously applied for i-Lestari, i-Sinar or i-Citra withdrawal initiatives, you can still enjoy this facility provided that you fulfill the requirements. You can check your current EPF account balance via the i-Akaun website, mobile app or EPF Kiosks.

How to apply for the RM10,000 EPF withdrawal?

Applications are accepted online through the official portal from 1st until 30th April 2022. Only online applications from the portal are accepted so beware of any fake apps claiming to provide applications for the EPF withdrawal.

The payout for the special withdrawal will be disbursed starting on 20th April 2022.

How much can you withdraw?

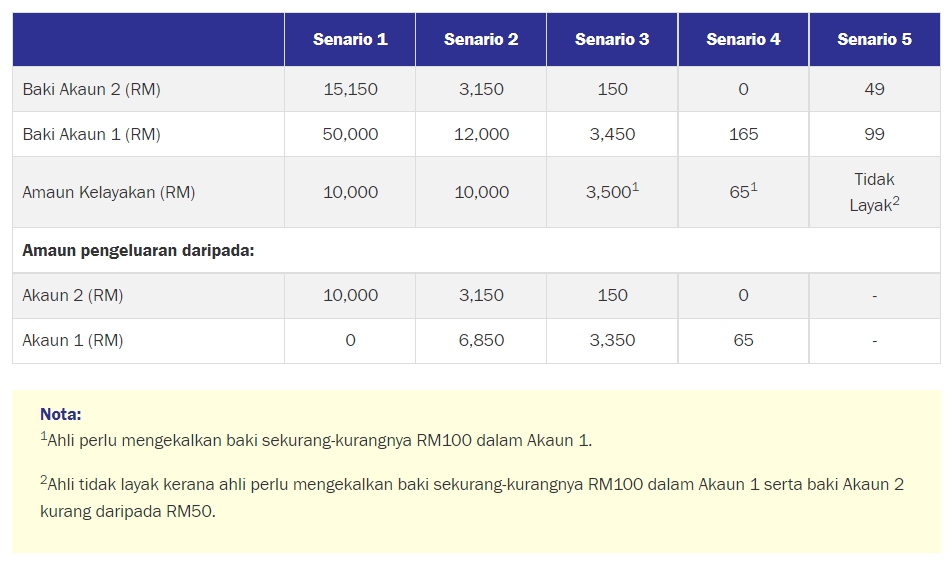

Eligible members can apply to withdraw from a minimum of RM50 to a maximum of RM10,000. However, there must be at least RM100 remaining in Account 1 after the withdrawal. According to EPF, this is to maintain the status of an active member.

As shown in the above example, the withdrawal will fully utilise Account 2 first before utilising Account 1 if there’s insufficient balance. If you don’t have RM150 in total (Account 1 + Account 2), you are not eligible to withdraw.

Do you need to repay back?

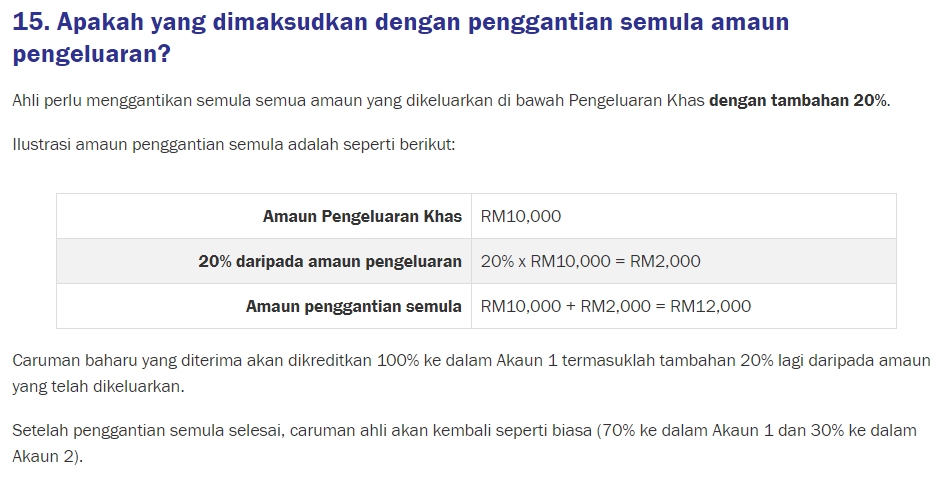

After making the withdrawal, you do not need to increase your monthly EPF contribution for repayment. However, the percentage of subsequent EPF contributions will be prioritised to Account 1 until it has been replenished with the desired amount.

According to the EPF, the replenishment of Account 1 will include an additional 20%. This means if you have withdrawn RM10,000, EPF will set to replenish a total of RM12,000 to Account 1 before resuming the usual distribution of 70% to Account 1 and 30% to Account 2 for your subsequent EPF contributions.

To recap, Account 1 is meant for retirement, while Account 2 can be used for other purposes including housing, medical, reducing loan repayment, education and haj.

Need further assistance?

If you have further questions, you can refer to EFP’s website or use the ELYA chatbot. You can also contact them on their social media platforms such as Facebook, Twitter and Instagram, or call them at 03-89224848.

[ SOURCE, IMAGE SOURCE ]

Related reading

- PM: Govt authorises another EPF withdrawal scheme up to RM10,000

- i-Citra: You can apply to withdraw RM5,000 from your EPF account today, here’s how

- EPF i-Sinar: How to check your application status online

- EPF i-Sinar applications are now open, here’s how to apply

0 comments :

Post a Comment